Pension scams regulations: Putting trustees in the ‘driving seat’

17th December, 2021

-

The DWP has published its response to its earlier consultation on pension scams – ‘empowering trustees and protecting members’, together with the final version of the Occupational and Personal Pension Schemes (Conditions for Transfers) Regulations 2021 (SI 2021/1237). Also, The Pensions Regulator (TPR) has issued accompanying regulatory guidance on dealing with transfer requests under the new regime[1].

The new provisions, which restrict the right to a statutory pension transfer in certain cases, came into force on 30 November 2021. In response to feedback, significant changes have been made to the final Regulations. In particular, there are now only two prescribed conditions, one of which must be met in order for a transfer to proceed (the second, third and fourth standalone conditions contained in the earlier draft regulations have been merged into one condition).

The Conditions for Transfers Regulations will apply to all statutory transfers where the date of the member’s application for a statement of entitlement or request to transfer occurs on or after 30 November 2021. It seems to be generally accepted that this means:

- For defined benefit transfers, where the member applies for a transfer quote on or after 30 November 2021 (so, whether the Regulations apply to non-money purchase transfers depends on the date a member requests their statement of entitlement)

- For defined contribution transfers, the new regime will apply where a member makes a written application to transfer on or after 30 November 2021.

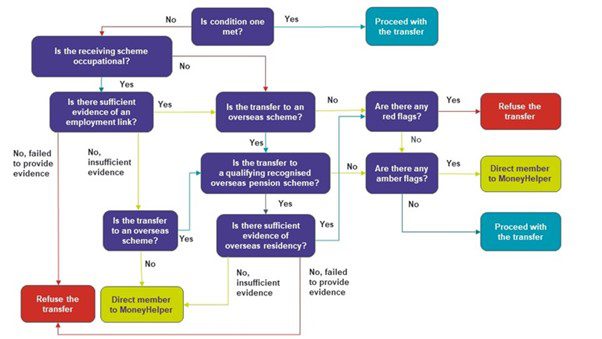

The TPR guidance, which sets out the process that should be followed for transfers from 30 November 2021, contains a useful ‘transfer process decision tree’ (accompanied by a transcript). The decision tree is reproduced below.

There are still some areas of uncertainty; in particular, Regulation 6(2) requires that a statutory transfer can only be made without contacting the member if the trustee can decide that certain amber and red flags are not present (see below). One of these amber flags is whether there is an overseas investment in the receiving scheme. Overseas investment is not defined. In almost all cases, the receiving scheme will have an overseas investment (even if just a fairly standard investment in global equity) and therefore a MoneyHelper referral would be required.

Nevertheless, trustees are now in driving seat in terms of their ability to prevent pension scams and there are actions they should be taking now.

- Discuss with your administrators how transfer processes will be updated, including changes to standard paperwork, processes for trustee evaluation and decision-making, and (where applicable) sharing of information between professional trustees and administrators.

- Agree a process with your administrators for deciding which transfer requests will be referred to your trustee board (or to a sub-committee) for a final decision.

- Maintain central lists of suspected scam or acceptable receiving schemes.

- Consider discretionary powers to pay transfers. TPR guidance suggests that trustees should still consider the new checks applicable to statutory transfers when deciding whether to agree to a non-statutory transfer request.

New conditions

Condition 1. The first condition will be met where a transfer is to:

- a public service pension scheme as defined in section 1(1) Pension Schemes Act 1993

- an authorised master trust which appears on TPR’s list of authorised schemes, or

- a collective money purchase scheme authorised by TPR.

Condition 2. Condition 2 is now made up of several elements.

- Employment or residency link

- Any red or amber flags?

Amber Flags Red Flags The member has not provided, or cannot provide, an employment link or overseas residency.There is evidence of high-risk or unregulated investments in the proposed receiving scheme. The proposed receiving scheme charges are unclear or high.

The proposed receiving scheme’s investment structure is unclear, complex, or unorthodox.

Overseas investments are included in the scheme.

There is evidence of a sharp or unusual rise in transfers involving the same proposed receiving scheme or adviser.

The member has failed to provide the required information.The member has not provided evidence of receiving MoneyHelper guidance. There is evidence that someone (e.g. the member’s adviser) has carried out a regulated activity without the right regulatory status.

There is evidence that the member requested a transfer after unsolicited contact.

There is evidence that the member has been offered an incentive to make the transfer.

There is evidence that the member has been pressured to make the transfer.

[1] New regulations empower trustees to halt suspicious transfers | The Pensions Regulator

Share article:-

Published bySusan McFarlane

Susan leads the marketing function for Dalriada Trustees Limited, and our sister company, Spence & Partners. The marketing team handles all promotional activity for the companies including business development, marketing, events and PR. Susan joined the business in January 2013, having...

-

Get in touch with us

Call us on 028 9041 2018 or fill out the form below and someone will get back to you.