The 2017 Dalriada Festive Blog

14th December, 2017

-

It’s a cold, rainy day here in Manchester and when I look outside the window, the streets are adorned with market stalls and lit by the festive lights which can only mean one thing… we’re nearing the end of another year and it’s time for another Dalriada festive blog!

When I volunteered to write our end of year blog, I should really have re-read last year’s to see what I was letting myself in for. I think Mr Copeland should have received the ‘pun of the year’ award for that entry.

2017 has been my first year here at Dalriada which has meant an upgrade in our Manchester office from Mr Roberts’ bachelor pad. Our headcount now stands at four in Manchester with interviews being carried out for another two members of staff, as I type.

We’ve seen great growth across our firm as well, with a new Birmingham office opening in October, our Belfast team moving into a new office (complete with a personal ‘wardrobe’ for Mr Spence), a new Leeds office opening in December and new recruits across all sites which take our total headcount to be 110.

So a good year for our business but what have been the main things that affected our pensions industry? You might be tempted to think, not a lot, but that’s not quite true.

Brexit and snap elections raised (and in the case of the former continues to raise) questions for trustee around uncertainty in the markets affecting their funding. Planning not panic is required.

As a professional trustee company we welcomed the Pensions Regulator’s 21st Century Trusteeship campaign to raising the standards of governance.

A cold calling ban to help stop pension scams – would there be one and when? Well the answer is yes but not for a while – 2020 is a likely start date. Too little to late? I’ll leave you to reach a conclusion.

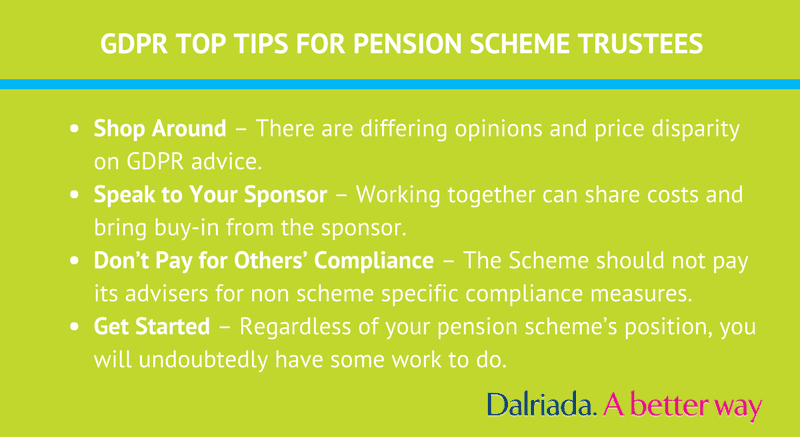

It would be wrong of me not to mention GDPR, even if just briefly, which must show in my Linkedin newsfeed 10 times a day. Our working party within our Group of businesses has and is busy working away to ensure we are fully compliant across all of our companies and for all our appointments. I’ll leave it there on GDPR but will point you to some useful guidance:

Last but certainly not least, the long awaited guidance from HMRC on the recovery of VAT in relation to DB services has recently been published.

Pleasingly, a pragmatic approach has been adopted which allows VAT on administration services to be invoiced to and recovered by the employer. In addition, the 70/30 rule for combined investment and administration services remains in place. It took a while but they got there!

For those that have already taken steps to change the approach, (e.g. Trustee VAT registrations, Group VAT registration, revising third party contracts) and where they remain the most suitable solution, HMRC have confirmed that the approach will continue to be accepted.

Unlike the weather, warm wishes from me and everyone here at Dalriada and all the best for 2018.

Share article:-

Published bySarah Brennan

Sarah is an experienced accredited professional pension trustee, starting in the pensions industry in 2003 in pensions administration. Acts as a Professional Trustee since 2013. Currently leads on a number of clients, ranging in asset size of £7m-£155m and particularly...

-

Get in touch with us

Call us on 028 9041 2018 or fill out the form below and someone will get back to you.

We’ve seen great growth across our firm as well, with a new

We’ve seen great growth across our firm as well, with a new