Effective System of Governance (ESoG): Where do we start?

1st September, 2021

-

Continuing on from our first two blogs on this subject (ESOG and ORA: The new architecture for pension scheme governance, ESOG: outsourcing activities, remuneration policies, proportionality and the ORA), how do you now start to establish and operate an effective system of governance?

Here’s the thing: If the Governing Body (the trustee board) isn’t first able to evidence that it is effective, how can the system of governance that it has implemented be effective? The starting point must therefore be an evaluation of the Governing Body itself.

So, how do you assess the effectiveness of your Governing Body?

Most trustee effectiveness assessments include what trustees do and don’t know, which is more of a Trustee Knowledge and Understanding (TKU) assessment. However, this can be quite important part in evidencing an ESoG.

By analysing the skills needed for your Governing Body, a TKU assessment will find any gaps in their skills. Your Business Plan will then record your gap fill strategy, with training and / or the appointment of a Professional Trustee to fill the skill gap needed.

Some trustee effectiveness assessments will also include behavioural bias, including personality profiling. The Institute and Faculty of Actuaries (IFoA) published its ground-breaking research earlier in 2021[1], focussing on the judgment and decision-making processes of pension trustees, using quantitative and qualitative in-depth interview methodologies. It examined the social and cultural context for decision making and offered an understanding of the ways in which decision biases are formed. Despite extensive training and displaying higher financial literacy than a lay person, the IFoA concluded that trustees are not immune from decision biases.

TKU, it would seem, is not enough on its own to evidence an effective Governing Body.

Some Trustee effectiveness assessments will review the processes, procedures, and internal control documents. This includes trustee policies and logs. While these are important parts of an effective Governing Body, other factors matter too. For example, operational planning, succession, diversity and inclusion, and contingency planning are also key.

Regulations require The Pensions Regulator to include the ESOG in a Code of Practice. These regulations provide for:

- sound and prudent management of activities,

- an adequate and transparent organisational structure with a clear allocation and appropriate segregation of responsibilities,

- an effective system for ensuring transmission of information,

- an effective internal control system and to ensure continuity and

- regularity in the performance of the activities, including the development of contingency plans.

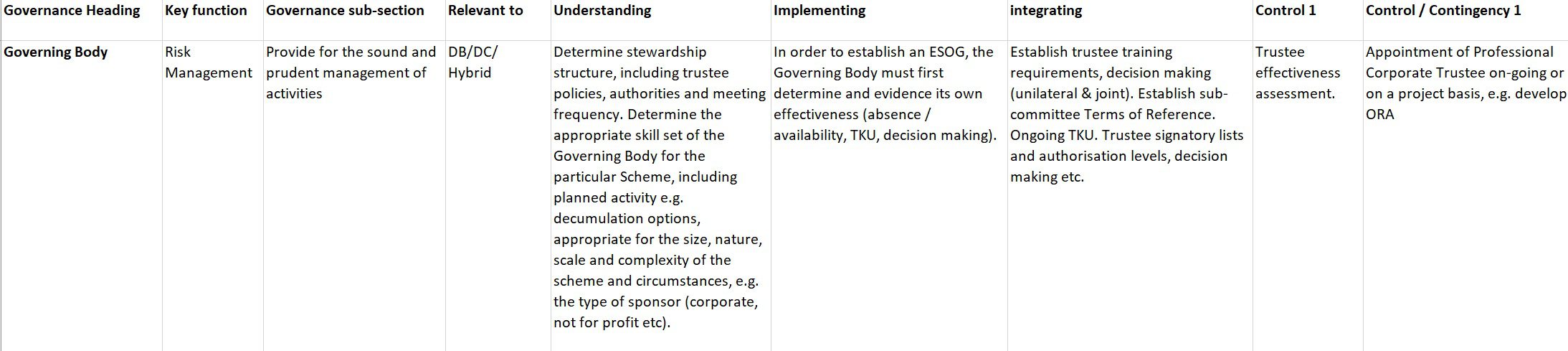

For your Governing Body, an excerpt from your ESoG framework might look like this:

Don’t forget, an ESoG is now wider than just effective internal controls. Contingency planning also isn’t just putting a Parental Company Guarantee in place.

A financial backup plan is good. However, it is not as effective as a continuity plan for your Governing Body. This plan is needed to ensure regularity in its activities.

So, what is an appropriate set of contingency plans for your Governing Body?

Let’s first identify your key risks, one of which is likely to be your key person risks. These might be the chair, your scheme secretary and/or pensions manager. So, what are your contingency plans to ensure continuity in these roles?

A deputy chair may be an appropriate and proportionate contingency plan for the chair. A professional trustee can also be very effective, but what type?

Would a self-employed or sole trader trustee be a good backup? Or do they create their own key person risk? If you have a self-employed or sole trader professional trustee who is also the chair, what is the extent of your key person risk? What skills does this professional trustee bring to the Governing Body? How easy or hard would it be to replace them quickly?

A lead trustee from a professional corporate trustee is supported by number of colleagues who can step in at any moment. I’ve needed to step in as lead trustee, pensions manager and scheme secretary, where the key person risk for those Governing Bodies has triggered, so it would seem to happen more often than you may think.

Risk Management – Stress testing

Having identified all of the key risks in your Governing Body, how do you then evaluate and evidence the effectiveness of your system of governance? Well, how do you know something is effective unless you have tested it?

Stress testing can be very helpful. Let’s imagine, with immediate effect, your scheme secretary is not expected to return for at least a month. What do you do?

On one occasion I asked our scheme secretary not to turn up for a meeting without prior notification to our co-trustees, in order to run a simulated stress test. Stress was the key word! Luckily, I’ve been a scheme secretary, but what do you then think became our contingency plan, should the scheme secretary be unavailable in future?

Proportionality

In respect of your Governing Body, your next question is then, what is proportionate for the size, scale, nature and complexity of your scheme and the system of governance?

Most non-professional trustees serve on a single Governing Body, so how can they appropriately evaluate proportionality, without guidance from their advisers? The advisers will have a level of experience of governance architectures across a number of schemes, however, what experience do the members of the Governing Body have to appropriately challenge their advisers on this point? The relatively limited experience of an in-house scheme secretary or pensions manager may also be of little assistance.

Here, a professional trustee will have the experience needed, with the benefit of having received advice from a number of advisers across a number of schemes. Professional corporate trustees, will have the widest experience of all, working in support of each other within the professional trustee firm.

Also, the wider experience of a third party scheme secretary and pensions manager, who operate across a number of schemes, can be very helpful in determining the appropriate proportionality for your scheme.

Having assessed your Governing Body, the skill set and behavioural biases, set the gap fill, analysed the key risks, determined the contingency plans, applied appropriate proportionality and stress tested the lot to evidence the sound and prudent management of activities etc, you can then think about your next stage: your governance framework, which we will cover in our next blog in this series.

Share article:-

Published byPaul Tinslay

Paul Tinslay is a Professional Trustee for DB and DC Pension Schemes, including Chair for Sole Trustee positions, and EGLAS arrangements. With 33 years in the Life and Pensions Industry, Paul has the very rare, if not unique experience of...

-

Get in touch with us

Call us on 028 9041 2018 or fill out the form below and someone will get back to you.